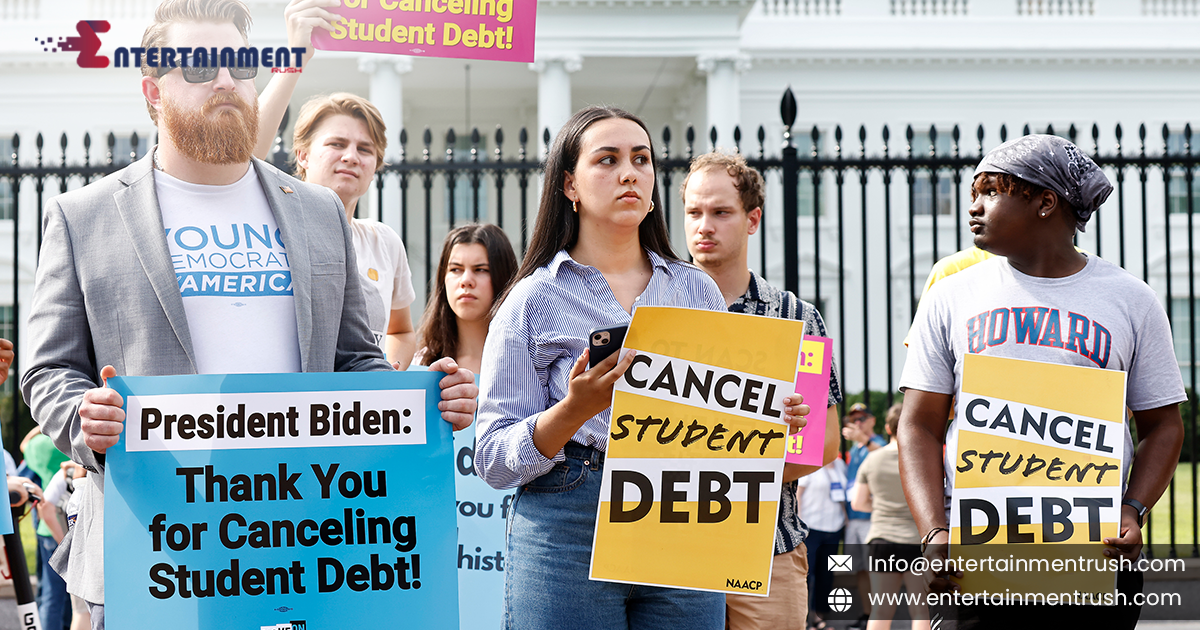

In a landmark move reflecting a central promise of his administration, President Joe Biden has announced the cancellation of billions in student loan debt. This significant policy shift is more than just a financial maneuver; it represents a pivotal moment in the ongoing discussion about higher education and student debt in the United States. With this action, Biden aims to address the mounting concerns of millions of Americans burdened by educational loans and to fulfill a key element of his campaign platform.

The Rationale Behind Student Loan Cancellation

Student loan debt has been a growing concern for many Americans, particularly as the cost of higher education has skyrocketed in recent decades. The burden of this debt has had profound effects on individuals’ financial stability, delaying milestones such as homeownership and impacting career choices. Recognizing these challenges, Biden’s administration has taken decisive steps to alleviate this financial strain.

What the Cancellation Entails

The cancellation plan involves significant relief for borrowers, targeting various levels of debt. Biden’s approach includes forgiving a portion of federal student loans for millions of borrowers, which aims to reduce the financial pressure on those with substantial educational debts. This measure is expected to bring immediate relief to those struggling with loan repayments and potentially stimulate economic growth by freeing up disposable income.

The Impact on Borrowers

For many Americans, the cancellation of student loan debt will mean a new lease on financial freedom. Individuals who have been diligently paying off their loans for years will see a reduction in their total debt, providing them with more opportunities to invest in other areas of their lives. This move could also have a broader economic impact, as increased disposable income may lead to higher consumer spending and investment in other sectors.

Challenges and Controversies

Despite the positive aspects of this policy, it has not been without its critics. Some argue that student loan cancellation could be perceived as unfair to those who have already paid off their loans or who did not attend college. Others question the long-term economic implications and the potential for increased government debt. These debates highlight the complexity of addressing the issue of student debt and the challenges involved in implementing such large-scale changes.

A Campaign Promise Fulfilled

The student loan cancellation plan is a key element of Biden’s broader educational reform agenda. It reflects his commitment to making higher education more accessible and affordable, aligning with promises made during his presidential campaign. By following through on this promise, Biden’s administration aims to demonstrate a tangible commitment to addressing one of the most pressing financial issues facing many American families.

Looking Ahead

As the administration moves forward with implementing this plan, attention will turn to how these changes will be rolled out and their long-term effects on both borrowers and the economy. The student loan cancellation represents a significant shift in the national conversation about higher education and financial responsibility, and its success will likely influence future policy decisions. Biden’s cancellation of billions in student loan debt is a landmark policy that addresses a central issue of his campaign and aims to provide substantial relief to millions of Americans. While the move has generated a mix of reactions, it stands as a significant step toward reshaping the landscape of higher education and financial responsibility in the United States.