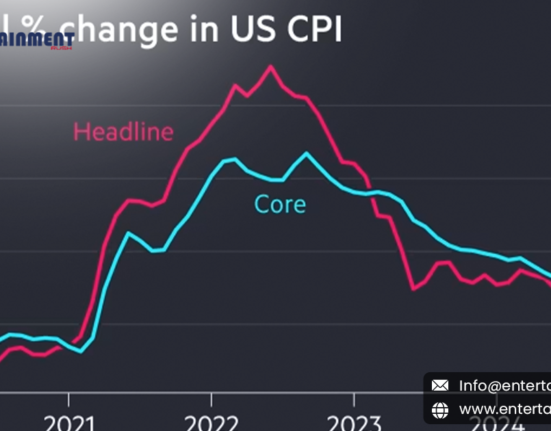

In the realm of economic indicators, few metrics garner as much attention as inflation rates. The latest report, heralding a notable decrease in inflationary pressures, brings a sigh of relief to investors and consumers alike. With core prices posting their smallest increase since 2021, the economic landscape appears to be stabilizing, prompting a wave of optimism in financial markets.

Inflation, often referred to as the silent thief eroding purchasing power, has been a persistent concern in recent times. From the volatility induced by supply chain disruptions to the ripple effects of unprecedented monetary stimulus, various factors have contributed to the inflationary pressures witnessed globally. However, the latest data signals a potential turning point in this narrative.

The core inflation rate, which excludes volatile components such as food and energy prices, serves as a crucial gauge of underlying inflationary trends. Its modest increase, aligning with market expectations, underscores a more tempered inflationary environment. This development not only provides respite to policymakers but also offers valuable insights into the dynamics of supply and demand within the economy.

Investors, perpetually attuned to economic indicators, greeted the news with enthusiasm, reflected in the upward surge of stock prices. The stock market, often considered a barometer of economic sentiment, responded positively to the prospect of subdued inflationary pressures. This optimistic response underscores the market’s confidence in the resilience of the economy and its ability to navigate through uncertain terrain.

The implications of easing inflation extend beyond financial markets, permeating into the everyday lives of consumers. A slowdown in inflationary momentum translates to stable prices for goods and services, alleviating concerns about eroding purchasing power. For businesses, this reprieve offers an opportunity to recalibrate strategies in response to evolving market conditions, fostering a more conducive environment for growth and investment.

Moreover, the significance of this development reverberates across the policy landscape. Central banks, tasked with maintaining price stability, closely monitor inflation trends to formulate monetary policies. The latest data, indicating a moderation in inflationary pressures, may influence the trajectory of future policy decisions, striking a delicate balance between stimulating economic activity and containing inflationary risks.

While the recent moderation in inflation brings welcome relief, it’s essential to recognize the fluidity of economic dynamics. The interplay of various factors, including global events and policy responses, can exert unpredictable influences on inflationary trends. As such, a vigilant approach to monitoring economic indicators remains imperative to navigate the ever-changing economic landscape effectively.

In conclusion, the latest report heralding a decrease in inflationary pressures, with core prices posting their smallest increase since 2021, instills a sense of optimism in financial markets and beyond. This development not only underscores the resilience of the economy but also offers valuable insights into the evolving dynamics of supply and demand. As investors cheer and stocks soar, the prospect of easing inflation provides a glimmer of hope amidst the uncertainties of the economic landscape.

Leave feedback about this