Financial innovation is a dynamic force that continuously reshapes the landscape of the economy, markets, and consumer behavior in the United States. From the advent of digital banking and fintech startups to the emergence of complex derivatives and alternative investments, the realm of financial innovation is expansive and multifaceted. This blog delves into the evolution, impact, and implications of financial innovation in the US.

Evolution of Financial Innovation

Transformative milestones punctuate the history of financial innovation in the US. The development of the stock market in the late 18th century laid the foundation for modern capital markets, enabling companies to raise capital and investors to participate in wealth creation. Throughout the 20th century, innovations such as mutual funds, credit cards, and securitization revolutionized consumer finance and investment practices.

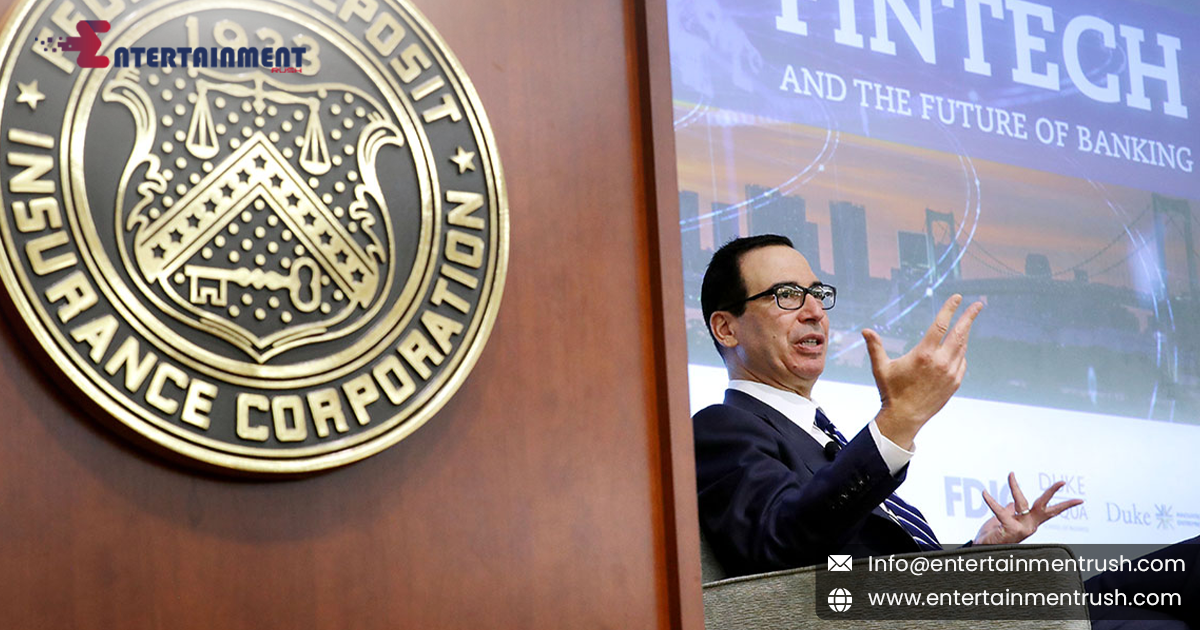

Rise of Fintech and Digital Disruption

In recent decades, the rise of fintech (financial technology) has emerged as a catalyst for disruptive innovation. Fintech startups leverage technology to enhance financial services, offering digital payments, online lending, robo-advisors, and blockchain-based solutions. This wave of innovation has democratized access to financial products and services, challenging traditional banking models and fostering greater financial inclusion.

Impact on Consumer Behavior

Financial innovation has profoundly influenced consumer behavior and preferences. The shift towards mobile banking apps, peer-to-peer payment platforms like Venmo, and robo-advisory services reflects changing attitudes towards convenience, transparency, and personalized finance solutions. Innovations in personal finance management tools empower individuals to take control of their financial well-being.

Regulatory Challenges and Responses

The rapid pace of financial innovation poses regulatory challenges for policymakers and regulators. Balancing innovation with consumer protection, privacy concerns, and systemic risk mitigation requires agile regulatory frameworks. Initiatives such as regulatory sandboxes and collaboration between industry stakeholders and regulators aim to foster responsible innovation while safeguarding the stability of the financial system.

Complex Financial Instruments and Risk Management

Financial innovation has introduced complex instruments such as derivatives, structured products, and algorithmic trading strategies. While these innovations offer opportunities for risk management and portfolio diversification, they also pose challenges in terms of transparency, market liquidity, and systemic risk. The 2008 financial crisis underscored the need for robust risk management practices and regulatory oversight of innovative financial products.

Sustainable Finance and Impact Investing

In response to societal and environmental challenges, financial innovation has extended to the realm of sustainable finance and impact investing. ESG (environmental, social, and governance) criteria are increasingly integrated into investment decisions, driving demand for green bonds, social impact funds, and responsible investment strategies. This shift reflects a broader emphasis on aligning financial goals with positive social and environmental outcomes.

Future Trends and Outlook

The future of financial innovation in the US is poised for further disruption and transformation. Emerging technologies such as artificial intelligence, machine learning, and decentralized finance (DeFi) are likely to reshape banking, investment, and risk management practices. Regulatory responses will play a crucial role in shaping the trajectory of innovation, balancing innovation with stability and consumer protection. financial innovation in the United States represents a journey of continuous evolution, disruption, and adaptation. From fintech startups to sustainable finance initiatives, innovation has redefined the ways individuals and institutions interact with financial markets. Embracing responsible innovation while addressing regulatory challenges will be essential in harnessing the transformative potential of financial innovation for the benefit of society and the economy.

Leave feedback about this