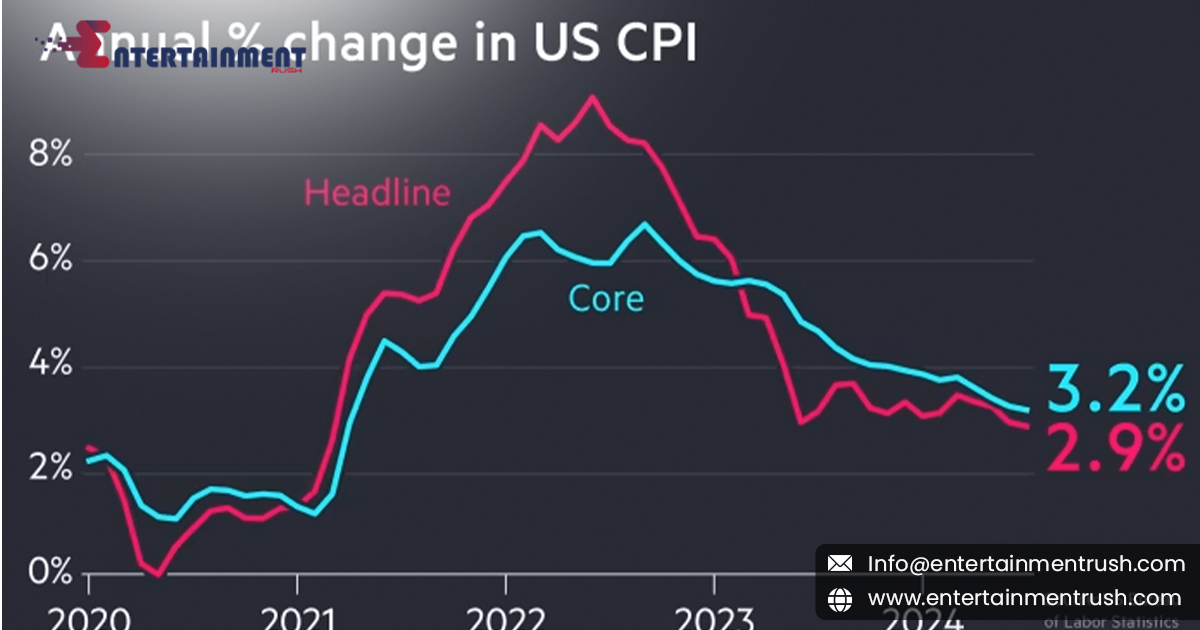

The recent report that inflation has cooled to 2.9% is a significant development in the ongoing economic narrative, one that has caught the attention of policymakers, businesses, and consumers alike. This easing of inflationary pressures is not only a welcome relief for households feeling the pinch of rising prices, but it also adds weight to the argument for a potential Federal Reserve rate cut.

Understanding the Inflation Decline

Inflation has been a major concern over the past few years, with rates climbing to levels not seen in decades. This surge in inflation has been driven by a combination of factors, including supply chain disruptions, labor shortages, and the massive fiscal stimulus measures implemented to counter the economic impact of the COVID-19 pandemic. As prices for goods and services spiked, the Federal Reserve responded by raising interest rates in an effort to cool the economy and bring inflation under control.

The recent data showing that inflation has eased to 2.9% marks a notable shift. This is the lowest rate in over two years, signaling that the Fed’s aggressive rate hikes may be starting to take effect. The cooling of inflation can be attributed to several factors, including improved supply chains, a stabilizing labor market, and the unwinding of pandemic-related fiscal support.

The Implications for Monetary Policy

The decline in inflation to 2.9% has sparked discussions about the future direction of Federal Reserve policy. For much of the past year, the Fed has been on a path of raising interest rates to curb inflation. Higher interest rates make borrowing more expensive, which in turn slows down consumer spending and business investment, helping to cool demand and bring down prices. as inflation begins to ease, the case for continuing to raise rates becomes less compelling. Instead, some economists and market analysts are now arguing that the Fed should consider cutting rates to support economic growth. The focus key phrase “Inflation Eases to 2.9%, Strengthening the Case for a Fed Rate Cut” captures this shift in sentiment, as the central bank weighs the benefits of maintaining high rates against the potential risks to economic expansion.

A rate cut could provide a boost to the economy by making it cheaper for businesses to borrow and invest, and for consumers to take out loans and spend. It would also ease the financial pressure on households carrying variable-rate debt, such as credit card balances and adjustable-rate mortgages, who have seen their interest costs rise significantly over the past year.

The Fed’s Delicate Balancing Act

The Federal Reserve faces a delicate balancing act as it considers its next move. On one hand, the decline in inflation suggests that the central bank’s efforts to bring prices under control are working. On the other hand, cutting rates too soon could risk reigniting inflationary pressures, especially if the economy proves to be more resilient than expected.

Fed officials have been cautious in their public statements, emphasizing that they will continue to monitor economic data closely before making any decisions. They have indicated that while the recent inflation data is encouraging, they want to see sustained evidence that inflation is on a downward trajectory before taking any action.

The Fed’s dual mandate of promoting maximum employment and stable prices means that it must carefully consider the impact of its policies on both inflation and the broader economy. With the labor market still relatively strong and unemployment at historically low levels, the central bank may be reluctant to cut rates too quickly, fearing that it could undermine the progress made in taming inflation.

What This Means for Consumers and Businesses

For consumers, the easing of inflation to 2.9% is good news. It suggests that the worst of the price increases may be behind us, making it easier for households to manage their budgets. If the Fed does decide to cut rates, it could lead to lower borrowing costs for things like mortgages, car loans, and credit cards, providing further relief to consumers.

For businesses, the prospect of a rate cut could be a positive development, particularly for those that rely on borrowing to finance their operations. Lower interest rates would reduce the cost of capital, potentially encouraging more investment and expansion. However, businesses will also need to remain vigilant about the broader economic environment, as any shifts in Fed policy could have ripple effects on everything from consumer demand to exchange rates.

As inflation eases to 2.9%, all eyes are on the Federal Reserve to see how it will respond. The central bank’s decisions in the coming months will be crucial in shaping the trajectory of the U.S. economy. While a rate cut is not guaranteed, the case for one is growing stronger as inflation continues to cool and the risk of an economic slowdown looms larger.

In the meantime, both consumers and businesses should stay informed and prepared for potential changes in the economic landscape. Whether through careful financial planning or strategic business decisions, understanding the implications of Fed policy will be key to navigating the uncertainties ahead.

As the debate over interest rates continues, the focus key phrase “Inflation Eases to 2.9%, Strengthening the Case for a Fed Rate Cut” will remain central to discussions about the future direction of the U.S. economy.