In the world of technical analysis, predicting market turning points is crucial for making informed trading decisions. One of the most popular tools for this purpose is the Stochastic Oscillator. This momentum indicator is widely used by traders to identify potential reversals and confirm trends. But how can you use the Stochastic Oscillator to predict market turning points effectively? Let’s dive into the mechanics of this tool, how it works, and strategies for applying it to your trading.

Understanding the Stochastic Oscillator

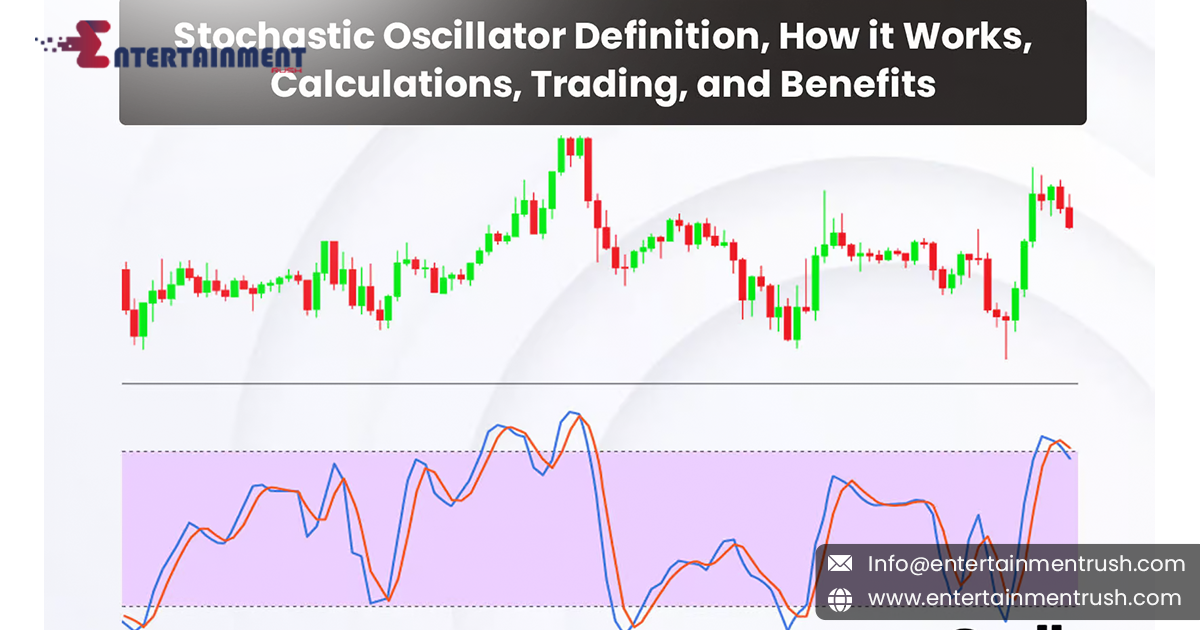

Developed by George Lane in the 1950s, the Stochastic Oscillator is a momentum indicator that compares a specific closing price of a security to its price range over a set period of time. It consists of two lines: the %K line, which represents the current closing price relative to the high-low range, and the %D line, which is a moving average of the %K line. These lines move within a range of 0 to 100, indicating the speed and momentum of price movements.

The basic premise of the Stochastic Oscillator is that prices tend to close near the high of the trading range in an uptrend and near the low in a downtrend. When the indicator reaches extreme levels, it suggests that the market may be overbought or oversold, signaling a potential turning point.

How Can You Use the Stochastic Oscillator to Predict Market Turning Points?

Identifying Overbought and Oversold Conditions

One of the primary ways to use the Stochastic Oscillator to predict market turning points is by identifying overbought and oversold conditions. When the oscillator reaches above 80, it indicates that the market is overbought, meaning the price is near its recent high and may be due for a correction or reversal. Conversely, when the oscillator falls below 20, it suggests that the market is oversold, meaning the price is near its recent low and may be poised for a bounce.

By monitoring these levels, traders can anticipate potential reversals. For instance, if the Stochastic Oscillator is above 80 and begins to cross down, it could be a signal to sell or consider taking profits. On the other hand, if the oscillator is below 20 and starts to cross up, it might be a buying opportunity as the market could be ready to turn upward.

Using Divergence for Early Warnings

Divergence between the Stochastic Oscillator and the actual price movement can be a powerful signal of an impending market turning point. Bullish divergence occurs when the price makes a new low, but the oscillator fails to follow suit and makes a higher low instead. This suggests that selling pressure is weakening, and a reversal to the upside could be imminent.

Conversely, bearish divergence happens when the price makes a new high, but the oscillator forms a lower high, indicating that buying momentum is fading. This can be an early warning of a potential downturn. By identifying these divergences, traders can use the Stochastic Oscillator to predict market turning points before they become evident in the price action.

Crossovers as Trading Signals

Another effective strategy for using the Stochastic Oscillator to predict market turning points is by observing crossovers between the %K and %D lines. When the %K line crosses above the %D line, it generates a bullish signal, indicating that momentum is shifting to the upside. Conversely, when the %K line crosses below the %D line, it produces a bearish signal, suggesting that momentum is turning downward.

Traders often use these crossovers in conjunction with other indicators or price patterns to confirm potential reversals. For example, if a bullish crossover occurs in an oversold area, it can strengthen the case for a buying opportunity. Similarly, a bearish crossover in an overbought area can reinforce the decision to sell or short the market.

Combining the Stochastic Oscillator with Other Indicators

While the Stochastic Oscillator is a powerful tool on its own, it is often used in combination with other technical indicators to improve accuracy in predicting market turning points. For instance, combining the Stochastic Oscillator with moving averages, support and resistance levels, or trendlines can provide additional confirmation for trades.

For example, if the Stochastic Oscillator indicates an overbought condition and the price is also approaching a key resistance level, the likelihood of a market reversal increases. Similarly, if a bullish divergence is spotted while the price is near a support level, it can strengthen the case for a potential rebound.

Adapting to Different Market Conditions

Different market conditions require different strategies, and the Stochastic Oscillator can be adapted accordingly. In trending markets, the oscillator might remain overbought or oversold for extended periods, making it less effective for predicting immediate reversals. In such cases, traders can adjust the oscillator’s settings to smooth out the signals or combine it with trend-following indicators to avoid false signals.

In range-bound markets, the Stochastic Oscillator tends to be more reliable for identifying turning points as prices oscillate between support and resistance levels. By understanding the prevailing market environment, traders can fine-tune their approach to using the Stochastic Oscillator effectively.

Conclusion

So, how can you use the Stochastic Oscillator to predict market turning points? By identifying overbought and oversold conditions, spotting divergences, observing crossovers, and combining it with other technical indicators, traders can effectively anticipate market reversals. The Stochastic Oscillator is a versatile tool that, when used correctly, can provide valuable insights into market momentum and potential turning points, helping traders make more informed decisions in both trending and range-bound markets.