In the dynamic landscape of financial markets, the 10-year yield stands as a pivotal metric, often scrutinized by investors and economists alike. As the 10-year yield edges up, investors find themselves at a crossroads, carefully weighing the implications of shifting monetary policy outlooks. In this article, we delve into the nuances surrounding the 10-year yield, exploring its significance, recent trends, and the profound impact it exerts on global markets.

Understanding the 10-Year Yield

The 10-year yield represents the annual return an investor receives for holding a U.S. Treasury bond with a maturity of 10 years. It serves as a barometer for investor sentiment, economic expectations, and monetary policy trajectories. Changes in the 10-year yield reflect shifts in bond prices, inversely influencing borrowing costs and investment decisions across various sectors.

Factors Influencing the 10-Year Yield

Monetary Policy Outlook

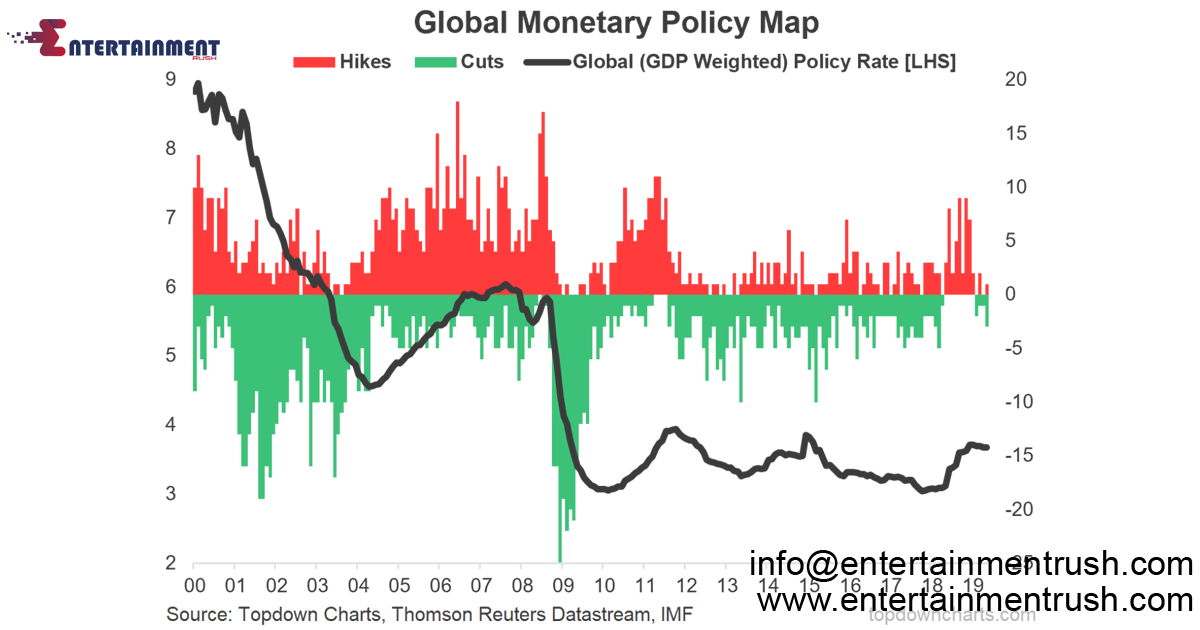

Foremost among the determinants of the 10-year yield is the prevailing monetary policy stance of central banks. Anticipated changes in interest rates, quantitative easing programs, and forward guidance statements from monetary authorities heavily influence investor expectations and bond yields.

Economic Indicators

Key economic indicators, such as inflation rates, GDP growth, and unemployment figures, play a pivotal role in shaping the trajectory of the 10-year yield. Positive economic data often translates to higher yields, reflecting expectations of tighter monetary policy to curb inflationary pressures.

Market Sentiment

Market sentiment, driven by geopolitical events, trade tensions, and global economic uncertainties, can lead to fluctuations in the 10-year yield. Investor risk appetite and flight-to-safety dynamics manifest in bond market volatility, impacting yields in the process.

Recent Trends in the 10-Year Yield

In recent months, the 10-year yield has exhibited a gradual uptrend, mirroring heightened expectations of monetary policy normalization amid robust economic recovery prospects. However, the pace and magnitude of yield movements remain contingent on evolving macroeconomic conditions and central bank communications.

Impact on Financial Markets

The 10-year yield exerts a profound influence across financial markets, shaping asset allocation strategies and risk management approaches.

Stock Market

Equity markets often experience heightened volatility in response to fluctuations in the 10-year yield. Rising yields can dampen investor sentiment, particularly in sectors sensitive to interest rate movements, such as utilities and real estate.

Bond Market

Within the bond market, changes in the 10-year yield influence the pricing of fixed-income securities, with bond prices and yields moving inversely. Investors may adjust their bond portfolios in anticipation of shifting yield curves and interest rate environments.

Foreign Exchange Market

Currency markets also react sensitively to movements in the 10-year yield, as changes in relative interest rates impact exchange rate dynamics. Strengthening yields in one currency may attract capital inflows, appreciating the currency vis-à-vis its counterparts.

Interpreting Changes in the 10-Year Yield

Investors employ various analytical frameworks to interpret changes in the 10-year yield, ranging from fundamental economic analysis to technical charting methodologies. Yield curve dynamics, yield differentials, and historical yield patterns offer valuable insights into market expectations and investor sentiment.

Strategies for Investors

During periods of fluctuating 10-year yields, investors adopt diverse strategies to mitigate risk and capitalize on opportunities. Asset diversification, duration management, and yield curve positioning form integral components of prudent investment approaches amidst yield volatility.

Regulatory Considerations

Regulatory bodies closely monitor developments in the bond market, particularly concerning systemic risks and market stability. Regulatory frameworks governing bond issuance, trading practices, and disclosure requirements aim to safeguard investor interests and maintain market integrity.

Expert Opinions and Long-Term Outlook

Financial experts and market analysts provide valuable perspectives on the future trajectory of the 10-year yield, considering macroeconomic fundamentals, policy dynamics, and global trends. Long-term projections underscore the importance of adapting investment strategies to evolving market conditions and risk profiles.

Leave feedback about this