Perfect competition is a foundational concept in economics that embodies an ideal market structure characterized by specific defining features. It represents a theoretical framework that elucidates fundamental market dynamics and economic principles, offering valuable insights into the functioning of markets within the complex landscape of the United States.

Key Characteristics of Perfect Competition

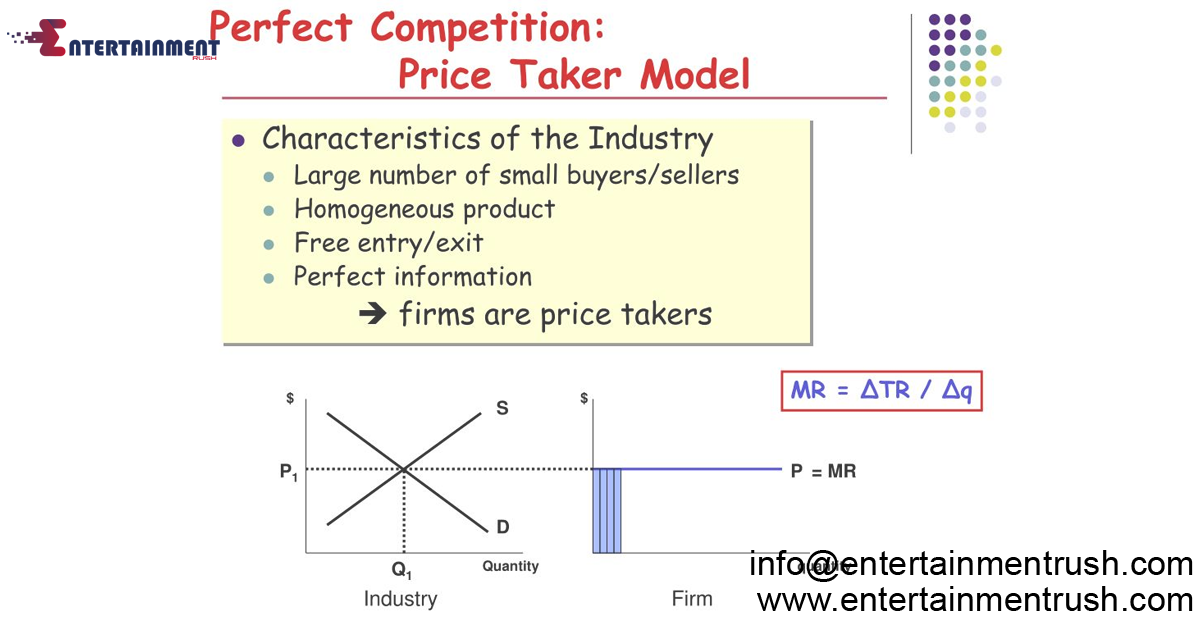

In a perfectly competitive market, numerous small firms operate independently, each offering identical products or services. This uniformity ensures that no single seller has the capacity to influence market prices independently, thereby making them price takers rather than price setters. Additionally, buyers possess complete knowledge of product prices, qualities, and availability, enabling them to make well-informed purchasing decisions based on market conditions.

Examples of Perfect Competition in the United States

Within the United States, certain industries approximate the characteristics of perfect competition. For instance, agricultural markets dealing with standardized commodities like wheat or corn exemplify perfect competition, where countless farmers produce nearly identical goods. Similarly, retail markets for basic consumer goods such as fruits and vegetables exhibit traits of perfect competition due to the abundance of suppliers offering similar products to consumers.

Absence of Entry and Exit Barriers

A critical hallmark of perfect competition is the absence of barriers to entry or exit. This means that any entrepreneur can freely enter or exit the market without encountering significant obstacles like high startup costs, stringent regulations, or exclusive access to resources. This fluidity enables firms to adjust their production levels efficiently in response to market fluctuations, facilitating optimal resource allocation and preventing long-term economic inefficiencies.

Economic Efficiency in Perfect Competition

Perfect competition is associated with both allocative and productive efficiency. Allocative efficiency occurs when resources are allocated in a manner that maximizes social welfare, with prices equal to marginal costs across all firms. This ensures that consumers receive goods and services at the lowest possible prices, accurately reflecting their societal value. Productive efficiency, on the other hand, refers to firms producing goods at the lowest possible cost per unit, thereby maximizing total output given available resources.

Real-world Deviations from Perfect Competition

Despite its conceptual appeal, perfect competition is rarely obsrved in its purest form in real-world markets. Many industries within the United States exhibit elements of imperfect competition, characterized by factors such as product differentiation, monopolistic tendencies, or oligopolistic market structures where a few dominant firms control significant market share.

Striving for Market Efficiency

In conclusion, a comprehensive understanding of perfect competition offers valuable insights into the foundational principles of market economics within the United States. While real-world markets often deviate from the ideal of perfect competition due to inherent complexities and market imperfections, striving to emulate its principles through effective regulatory frameworks and competition policies can enhance market efficiency, foster innovation, and ultimately benefit both producers and consumers across diverse economic sectors. Embracing the essence of perfect competition can pave the way for more equitable and competitive markets that drive economic growth and societal welfare.

Leave feedback about this